Contents:

Because in either case, if you’re not conscious, you might put youhttps://1investing.in/elf at a lot of financial disadvantage. Investors are usually advised to behave carefully when the markets are overvalued and not get carried away with the public sentiment. In October, BSE Sensex reached 62,245 points, and even while closing in December, it was above the 57,000 mark. As on January 31, 2023, the PEs of MSCI World and MSCI EM stood at 18.18x and 12.83x, respectively. Even after the Hindenburg report came, the Nifty50’s PE averaged 20.86x at the end of February 2023 – higher, not lower, than it was before January 24, 2023.

- Growth stocks are a great example of overvalued stocks that go up in value.

- Every investor looks for the intrinsic value of the stock to know if it is overvalued or undervalued.

- According to several estimates, while the economy is recovering pretty well, it will take significant time to be fully back to normal.

- Change in earnings –When the economy tanks and there is the impact on public spending, a company’s profits could drop.

- I agree to the updated privacy policy and I warrant that I am above 16 years of age.

This Website makes no representations or warranties as to the fairness, completeness or accuracy of Information. There is no commitment to update or correct any information that appears on the Internet or on this Website. Information is supplied upon the condition that the persons receiving the same will make their own determination as to its suitability for their purposes prior to use or in connection with the making of any decision. Neither ABCL and ABC Companies, nor their officers, employees or agents shall be liable for any loss, damage or expense arising out of any access to, use of, or reliance upon, this Website or the information, or any website linked to this Website. This Agreement describes the terms governing the usage of the facilities provided to you on the Website. Clicking “I Agree” to “Terms & Conditions”, shall be considered as your electronic acceptance of this Agreement under Information Technology Act 2000.

Limitations of Investing in Value Stocks

The dividend is a part of the profit the company distributes to its shareholders. The dividend yield is the annual dividend that the company offers as a percentage of its stock price. For instance, if the stock trades at ₹50, and pays an annual dividend of ₹5 per share, then the company is said to offer a 10% dividend yield.

4 stocks to watch on Tuesday: CarMax, Boeing and more (NYSE:KMX) – Seeking Alpha

4 stocks to watch on Tuesday: CarMax, Boeing and more (NYSE:KMX).

Posted: Tue, 11 Apr 2023 12:16:08 GMT [source]

But Hindenburg has found that one little-known audit firm, called Shah Dhandharia, was also an auditing partner. It says Adani Enterprises and Adani Total Gas’ annual audits were signed off by youths “fresh out of school”. “They were 23 and 24 years old when they started approving financials,” it alleges. Adani said the matter was settled after payment of penalties by 14 Adani group entities in 2008.

Which are the most overvalued stocks in India right now?

Now, all open positions at the end of the day have to be settled, and that would not work because the speculator does not own the stock. About the possibility of corrections to those share prices, picture abhi baaki hai. For a conglomerate as big as Adani Group, one would expect the Big Four or Six companies to audit their books.

What does it mean if a stock is overvalued?

A company is considered overvalued if it trades at a rate that is unjustifiably and significantly in excess of its peers. Overvalued stocks are sought by investors looking to short positions and capitalize on anticipated price declines.

“KYC is one time exercise while dealing in securities markets – once KYC is done through a SEBI registered intermediary (broker, DP, Mutual Fund etc.), you need not undergo the same process again when you approach another intermediary.” Many value stocks take too long to arrive at their fair values and may not offer quick gains. This can happen even if you hold them for longer, there is no guarantee that they will reach your assigned fair values. Take a look at the table ‘Leaders and Laggards’ for a comparative performance over the past year and past month. Only one stock out of the ten constituents of the index has delivered a negative return in the past 12 months. Six stocks have beaten the index performance with outstanding returns of 45 per cent or more.

How To Make The Most Of Stock Market Corrections?

An IPO lock-in how to invest 1,000 dollars is a time span post listing during which pre-IPO investors are not eligible to sell their shares. Hindenburg Research, an American short-selling firm, said that it held short positions in the Adani group through US-traded bonds and non-Indian-traded derivative instruments. It accused the group of participating in brazen stock manipulation and accounting fraud schemes over decades, after which the share price of all the listed companies tumbled to the tune of 50%. Mutual Fund investments are subject to market risks, read all scheme related documents carefully before investing. The Facilities Provider, ABC Companies or any of its third party service providers and processor bank/merchants etc. shall not be deemed to have waived any of its/their rights or remedies hereunder, unless such waiver is in writing. No delay or omission on the part of Facilities Providers and ABC Companies, in exercising any rights or remedies shall operate as a waiver of such rights or remedies or any other rights or remedies.

What is an overvalued stock example?

An overvalued asset is an investment that trades for more than its intrinsic value. For example, if a company with an intrinsic value of $7 per share trades at a market value $13 per share, it is considered overvalued.

However there is no conflict on these services and commissions if any payable are in accordance of the extant regulations. These Terms of Use and any notices or other communications regarding the Facilities may be provided to you electronically, and you agree to receive communications from the Website in electronic form. Electronic communications may be posted on the Website and/or delivered to your registered email address, mobile phones etc either by Facilities Provider or ABC Companies with whom the services are availed. All communications in electronic format will be considered to be in “writing”. Your consent to receive communications electronically is valid until you revoke your consent by notifying of your decision to do so.

More News

It is better to form bear market plans now when investors have ample time and a clear head. The P/B Ratio can vary significantly for companies within the same sector. For example, among tech stocks in India, the P/B Ratio can range from 4 times to 20 times the sector P/B Ratio. Defining expensive and inexpensive stocks based on P/B Ratio ensures that value investors do not get carried away by chasing the most popular names in a specific sector.

You may receive e-mails /communications/notifications from the Third Party Services Providers regarding facilities updates, information/promotional e-mails/SMS and/or update on new product announcements/services in such mode as permitted under law. Further, the Facilities Provider cannot always foresee or anticipate technical or other difficulties. These difficulties may result in loss of data, personalization settings or other facilities interruptions. The Website does not assume responsibility for the timeliness, deletion, mis-delivery, or failure to store any user data, communications, or personalization settings. We may provide you with various money solutions and options which are generally available basis your investment profile or those which are generally held by persons of similar investment profile.

How to Determine Whether a Stock is Overvalued?

Damodaran observed that the last decade has seen an explosion of risk capital, aided and abetted by central banks and policymakers. Now suppose the management of the company undergoes a change, and the new management revalues the assets. The new management determines that the life cycle of its cars is 10 years instead of 5 years. So, the annual depreciation of the company’s assets will decrease to Rs. 100 crore.

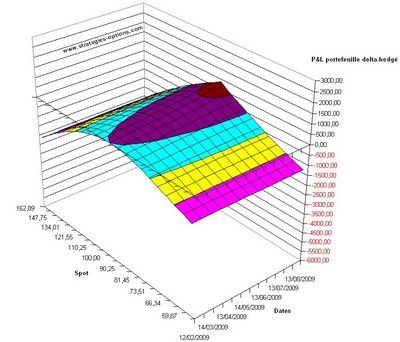

Investors short sell when they believe a stock is overvalued and expect the stock price to go down. And, according to a podcast on the Economist, that’s what attracted Hindenburg Research to dig into the Adani Group stocks. At present, in a realistic sense, there is no short selling in India. But actual short selling – which involves borrowing shares for a multi-day horizon – is absent in India.

MSCI India’s 10-year return stands at 11.2 per cent compounded annually against a negative return of 1.6 per cent for MSCI EM during the same period. Buffett indicator value for India stood at 105 level as of October end, based on FY23 projected nominal GDP levels. This is even as the 12-year average indicator value for India stands at only 79 level. At the right price, I would be willing to expose myself to those risks, but it would require a significant discount on intrinsic value, and we are not even to close to that point yet.

The Indian companies filtered would have compounded wealth at 24% over the last 20 years, while the Chinese companies would have compounded at 12%. Today Maharashtra’s GDP is equal to what whole of India’s GDP was in 2005. The combined GDP of Uttar Pradesh and Uttarakhand is what India’s GDP was in 2001. And three states—Tamil Nadu, Gujarat and Karnataka—combined GDP is where India was in 2000. Can we assume that over the next years, these states will produce what India is producing today, if all of us continue to work as hard? Now, in which part of the world would you see states becoming as big as the country, with reasonable amount of assurance.

Is it good to buy overvalued stocks?

In short – if a stock is overvalued, you're going to be overpaying if you decide to buy it – and that's something you always want to avoid.

When an investor has a negative view of a stock, she will sell the stock futures. You expect the price of the share will go up after, say, three weeks, so you buy a futures contract. [Futures are financial derivative instruments used to buy or sell a specific commodity asset or security at a set future date for a set price. If the price of the underlying asset increases, then the price of the derivative also increases.

Which stocks are overvalued right now?

- #1 ADANI GREEN ENERGY.

- #2 BAJAJ HOLDINGS & INVESTMENT.

- #3 ADANI TOTAL GAS.

- #4 TRENT.

- #5 ADANI ENTERPRISES.

Leave a Reply